It can be difficult to come to terms with the fact that you need to file for bankruptcy. You may feel overwhelmed, embarrassed, and frustrated. However, it is important to know that you're not alone. Millions of Americans have already filed for bankruptcy and many more will do so in the future.

Bankruptcy is a very common way for individuals and businesses to deal with overwhelming debt. Unfortunately, there are many stigmas and myths associated with bankruptcy that contribute to a fear of filing for many individuals. By learning more about bankruptcy, you can gain the courage to move forward and set yourself on a path to a future of financial freedom.

At Steele Law Firm, we believe that knowledgeable bankruptcy support is essential for our clients. As a result, we offer personalized consultations to all prospective clients before the filing process begins. We encourage you and other Burleson residents to discuss your options with an attorney when struggling under the weight of overwhelming debt.

If filing for bankruptcy is right for you, we will be by your side every step of the way. Facing this difficult decision can be daunting but with our help, you will be on your way to a fresh start.

Bankruptcy is a solution to the state of financial crisis that occurs when you are unable to pay your debts. The process allows you to either create a repayment schedule or liquidate certain assets to repay some debts and may allow you to discharge others. For a bankruptcy filing to be successful, it must meet the requirements set forth by the United States Bankruptcy Code.

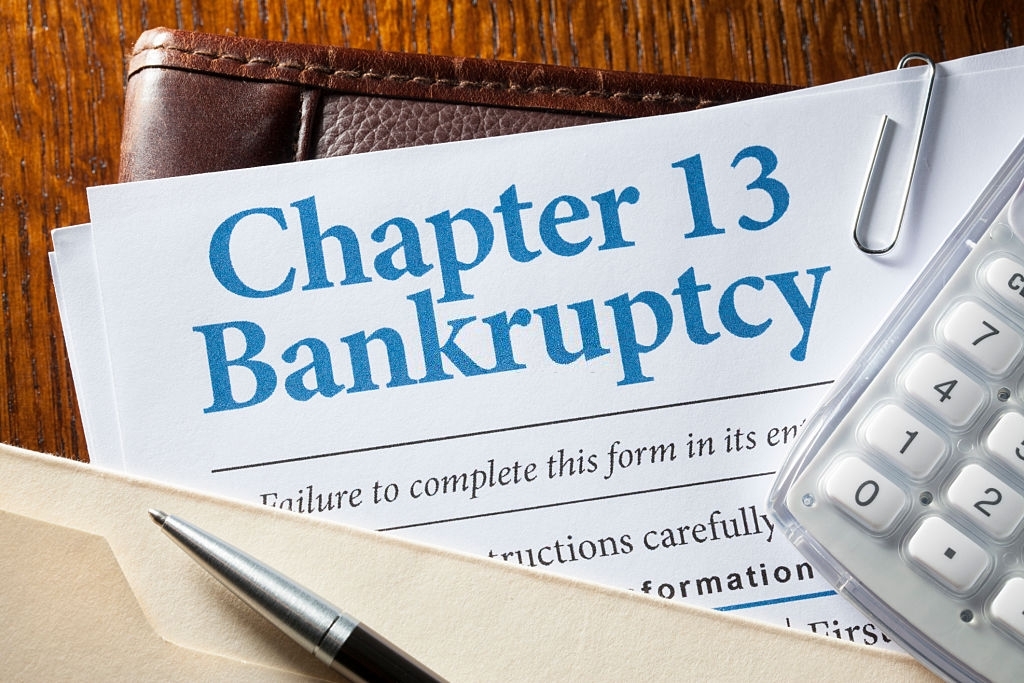

The bankruptcy code outlines two common forms of bankruptcy for individuals: liquidation and reorganization. A liquidation bankruptcy under Chapter 7 will eliminate most if not all your debt by selling your assets to repay your debtors. A reorganization bankruptcy under Chapter 13 will allow you to create a repayment plan to pay some or all your debts over time.

When you file for bankruptcy in Texas your creditors are required by law to immediately cease any collection efforts against you, following notification from the court that a bankruptcy has been filed. This automatic stay goes into effect right away and is in place until the bankruptcy has discharged your relevant debts. In this way, bankruptcy allows you to experience peace of mind as your financial situation is being addressed by a Burleson bankruptcy lawyer.

The first step in filing for bankruptcy is an eligibility determination that includes a review of what kind of debts must be included and whether any assets must be liquidated to pay off your debt. If you have a great deal of assets, it may not be feasible for you to file for bankruptcy due to the liquidation requirements set out by Texas state law.

The next step will be to determine which bankruptcy option will be most effective given your income level. If your income is too high, it will limit your ability to file for certain types of bankruptcy. The Texas means test disqualifies individuals above the Texas median income from filing Chapter 7 bankruptcy. You must also conduct the Texas means test if you are above the Texas median income and wish to file Chapter 13 bankruptcy—your total household income, the type of debt you have accrued, and any exemptions like veteran status can affect your qualification.

The final step in the filing process is filing the bankruptcy petition with the court. This document includes your financial information as well as a list of your creditors. Once the petition is filed, the court will appoint a bankruptcy trustee who will ensure your assets appropriately satisfy the terms of your bankruptcy agreement.

As mentioned, stigmas and myths associated with bankruptcy prevent many individuals who could benefit from bankruptcy from beginning the process. Some of the most common myths are:

These myths couldn't be further from the truth. Bankruptcy protects your assets and relieves you of a significant portion of your debt so you can rebuild your credit rating and set yourself up for future financial success.

The value of a Burleson bankruptcy lawyer begins with helping you understand your options and continues with the ultimate assurance that your bankruptcy filing will proceed smoothly. Your attorney will be with you every step of the way, fighting for your best interests and ensuring each legal requirement is met.

Other common services provided by bankruptcy attorneys include:

These are just some of the many benefits of working with a qualified Burleson bankruptcy lawyer. We find that the most significant value lies in knowing that you are doing what is best for your current and future financial health.

Filing for bankruptcy can be an intimidating process, but you can feel more at ease with the help of a qualified Burleson bankruptcy lawyer. At Steele Law Firm, our mission is to help you protect your assets, reduce your debt, and start anew to build your financial freedom.

Our team of experienced professionals are passionate about helping people in need. Our entire law firm exists with this dedicated focus on bankruptcy law, further exemplifying our commitment to this type of financial solution. Please connect with us today for a personalized consultation and begin your path to financial success.